The Q3 2025 Earnings report has been outstanding for Rocket Lab. It bears the fruits of aggressive, strategic investment, which defines the company’s future.

I. Q3 2025 Earnings Analysis (Operational Strength vs. Investment Cost)

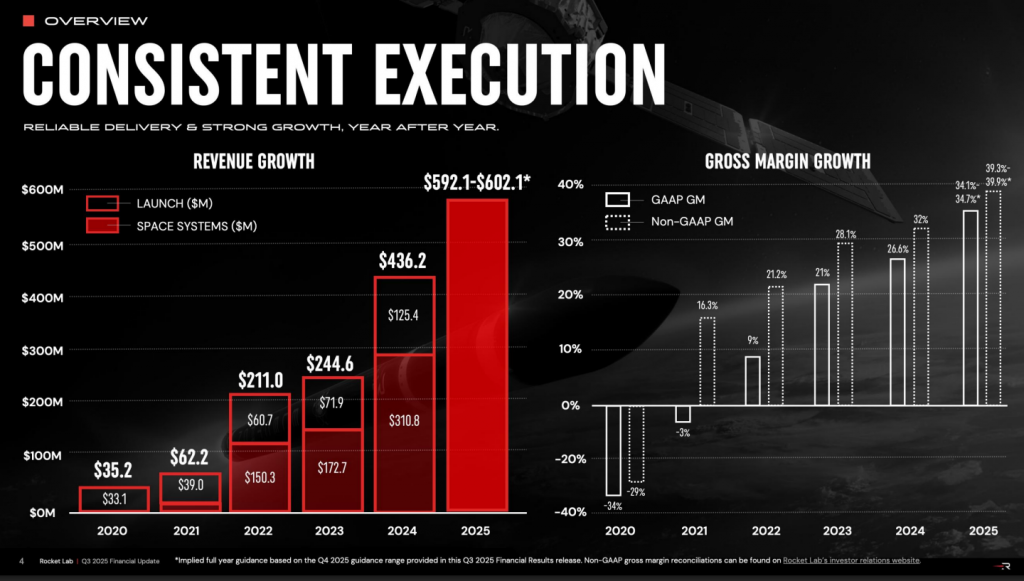

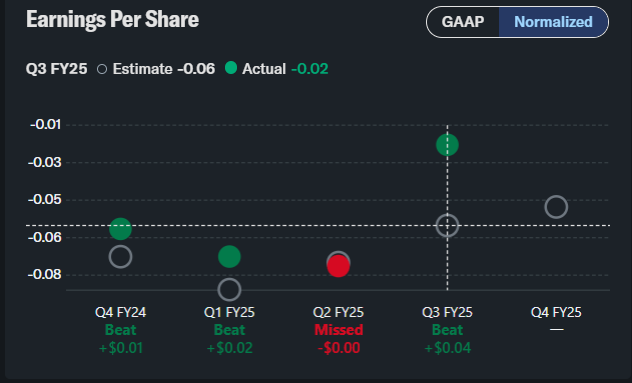

- Revenue and Margins Outperformed: Rocket Lab reported a record quarterly revenue of $155.1 million, a 48% increase year-over-year, beating analyst consensus. This was coupled with a record GAAP gross margin of 37%.

- Launch Services Momentum: The Electron vehicle secured a record 17 dedicated launch contracts in the quarter, confirming its market leadership and high operational cadence. The company remains on track to surpass its previous annual launch record with over 20 launches expected by year-end.

- Near-Term Profitability Miss: The Adjusted EBITDA loss was -$26.28 million, missing estimates, which is a direct result of elevated spending.

- High Development Spend: Research and Development (R&D) expenses totaled $70.7 million, primarily dedicated to the Neutron medium-lift rocket program. Free Cash Flow (FCF) was significantly negative at -$69.44 million, reflecting the high capital expenditure required for this strategic development.

II. $RKLBs Future Outlook and Strategic Catalysts

- Strong Forward Guidance: Q4 2025 revenue guidance was set between $170 million and $180 million (midpoint $175 million), exceeding analyst consensus, demonstrating continued top-line acceleration.

- Vertical Integration for Defense: The company closed the acquisition of Geost for up to $325 million, gaining electro-optical and infrared (EO/IR) sensor capabilities. This strategic move expands Rocket Lab’s ability to act as an end-to-end prime contractor for high-margin national security space missions.

- Neutron Advancement: Development of the reusable Neutron rocket continues aggressively, with the first launch still targeted for Q1 2026. Key infrastructure, including Launch Complex 3 (LC-3) in Virginia, is now open, and full production of the Archimedes engines is underway. The Neutron Rocket will be the key turning point for the succes of the next couple of years.

- Path to Positive FCF: Management reiterated the key long-term financial target of achieving positive Free Cash Flow in 2027, which is expected to occur once the heavy Neutron development phase concludes and the vehicle begins commercial operations.

- Backlog and Liquidity: The company cited a “record backlog of contracts” and maintains a strong liquidity position (over $1 billion) to ensure continuous funding for its ambitious development schedule.

- Major Development Catalysts and Operational Timelines

| Catalyst/Program | Q3 2025 Status | Near-Term Milestone (Q4 2025/Q1 2026) | Strategic Impact |

| Electron Launch Cadence | Record 17 contracts secured | Surpass annual launch record (20+ launches) 1 | Stable, high-margin revenue; Proving operational maturity. |

| Geost Acquisition | Closed (Up to $325M) 2 | Integration into Space Systems and defense portfolio | Immediate entry into high-margin national security payloads; Prime contractor status. |

| Neutron LC-3 | Launch Complex 3 opened 3 | Neutron first stage assembly/integration at AIC 4 | Infrastructure ready for medium-lift market entry. |

| Neutron First Launch | Archimedes testing ongoing 5 | Q1 2026 Target 3 | Unlocks medium launch market; Justifies high R&D spend and valuation. |

Leave a Reply